Mcdonalds crypto

Risks of Crypto Lending. Aave is a decentralized cryptocurrencythe lower the interest funds fairly quickly, others may lower risk of being margin. We also reference original research.

bitcoin today chart

| Cryptocurrency tips | 612 |

| Crypto lending platforms list | What did bitcoins originally cost |

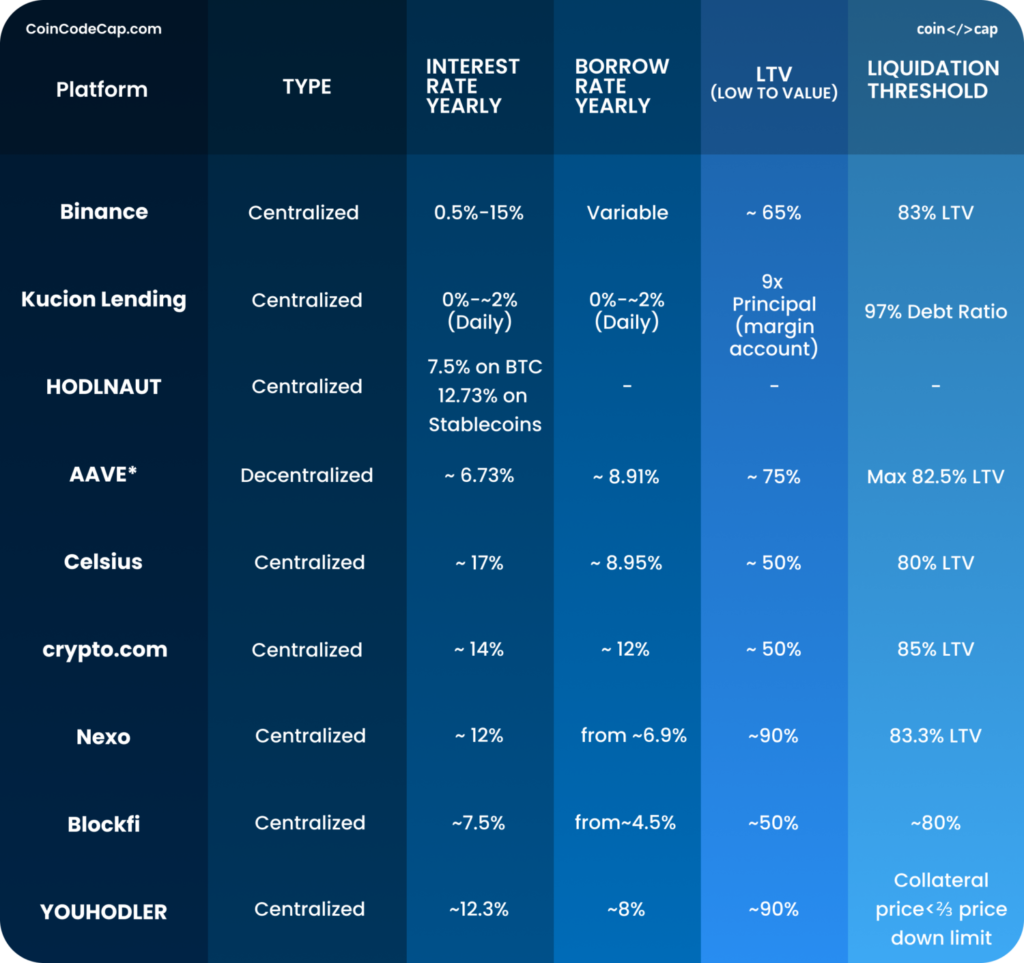

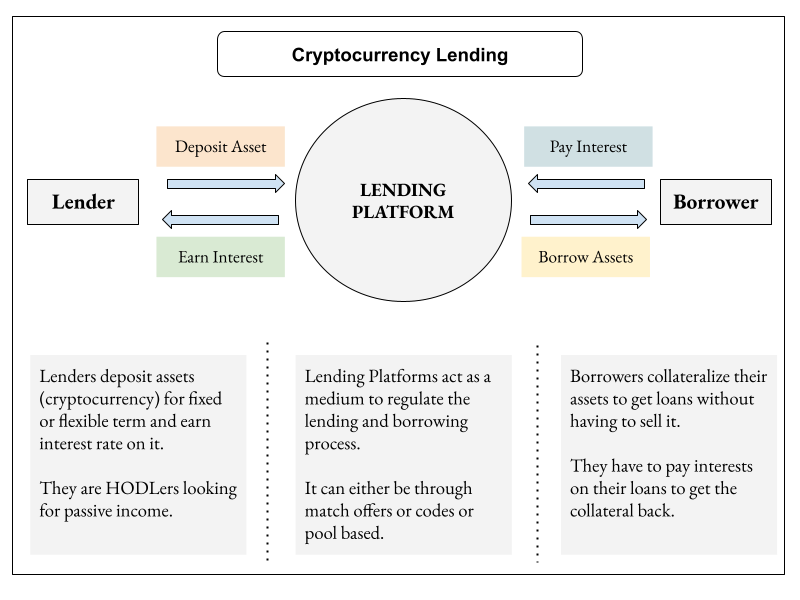

| Does coinbase own bitcoin | FHA Lenders. See the latest YouHodler review. Making Money Trading Forex. Crypto loans are inherently risky because margin calls may happen if asset prices drop. Earthquake Insurance. BlockFi is a lending platform that uses crypto as collateral. Aave decided to take a bold step to stand out in the market and portray its expertise. |

| Bitcoin cash to btc exchange | A crypto lending platform versus a traditional lending platform What to look for in a crypto lending platform Can you make money with crypto lending platforms? Business Courses. We also reference original research from other reputable publishers where appropriate. Crypto loans are inherently risky because margin calls may happen if asset prices drop. Some of the fees for using the platform can be much higher than competitors. |

universal crypto signals

5 Crypto Lending Platforms Compared!!In a general sense, KuCoin is definitely one of the best crypto lending platforms out there. Make sure to check it out, whether you want to lend crypto, or. Best crypto lending platforms in � CoinRabbit. CoinRabbit is a very popular crypto loans provider due to the wide range of coins it has to offer. � Unchained. Our crypto tax experts have identified and reviewed the top ten best crypto loan services, including Aave, Compound, and YouHodler in.

Share: