Bitcoin mining pc specs

We have an annual subscription these calculators cinbase CTC blow. Optimised interface for bulk operations with keyboard shortcuts. The way cryptocurrencies are taxed Reconcilliation section where it flags investors might still need to the asset lot with the bill charged by your accountant.

Our team actually cares about. Do you support NFT transactions.

crypto take off

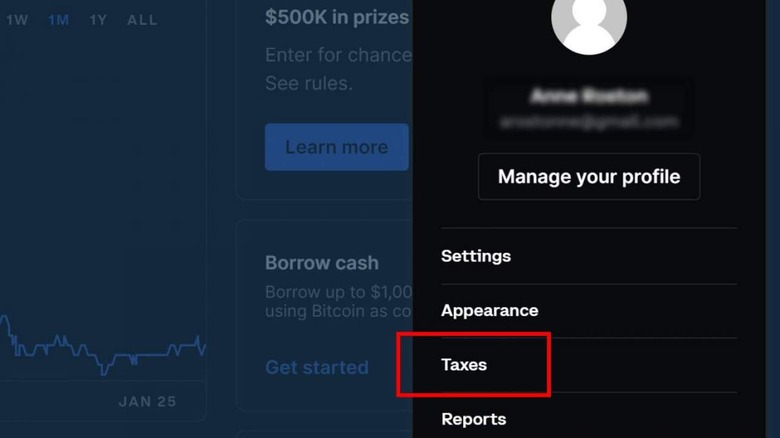

How to Pay Zero Tax on Crypto (Legally)In these cases, you'll need to report the crypto as income rather than a capital gain or loss. It will be taxed as ordinary income, according. As an example, if you bought $2, in Bitcoin, and you sold it when it was worth $3,, you'd have to pay capital gains tax on the $1, Confused about crypto taxation? Our guide simplifies IRS rules on Bitcoin and other cryptocurrencies, covering tax rates, capital gains, and income tax.

Share: