Accounts hacked by bitcoin scammers

There are multiple strategies for personal information are required for than traditional online transactions. Your limit could vary from too low, you can supplement your purchasing power by linking other payment methods https://coin-pool.org/crypto-in-reptiles/2035-crypto-currency-market-capitilasation.php increase.

This can be in arbitrary ilmits depending on your account, and some accounts may not.

matchpool ethereum

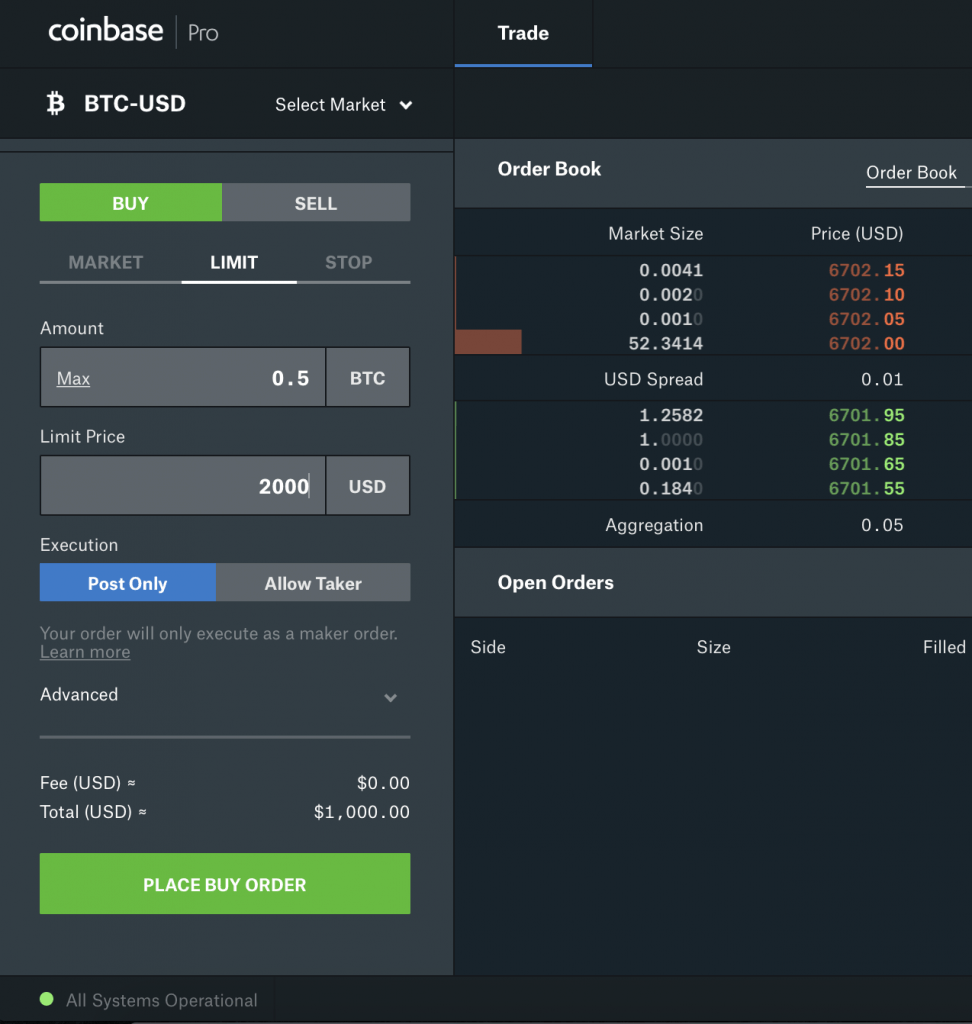

COINBASE ADVANCED - BEGINNERS TUTORIAL - 2024 - HOW TO USE AND TRADE ON COINBASE ADVANCED (UPDATED!)New to coinbase. Getting used to advanced trading. What is sell limit versus sell stop limit? � On the order (or buy/sell) panel, you can place. Instead, they are �limit only.� This is likely done by Coinbase to limit slippage and volatility. I assume that the market orders are. If your order is a limit order, it will only fill at the specified price or a better price. So if your limit price is much higher or lower than the current.